The Cluster.... of Net Zero

- Chris O'Meara

- Oct 5, 2021

- 6 min read

Updated: Nov 2, 2021

As one astute Italian observer put it “the arithmetic of energy is pretty straightforward. Resources are depleting fast, as the easier and cheaper to extract have been extracted.

As one astute Italian observer put it “the arithmetic of energy is pretty straightforward. Resources are depleting fast, as the easier and cheaper to extract have been extracted. At the same time, the global population is still growing [and therefore energy consumption]. Starving fossil fuel producers of capital might not have been the best decision.”

As we noted back in June, climate related pressures are building on public oil companies. In June, a court in the Netherlands ruled that Shell needs to reduce its emissions by 45% by 2030 in absolute terms. Shareholders of Exxon also voted in support of board members nominated by ESG activist Engine No.1. The Net-Zero Banking Alliance was formed, which calls on participating banks to set targets for decarbonisation of their lending portfolios. The International Energy Agency (IEA) noted recently that in order to meet the ‘Net Zero by 2050’ objective, “no new oil and natural gas fields are needed.” While we agree completely agree with the medium term shift away from fossil fuels some of the decisions to constrain capital available for public oil companies have clearly contributed to the recent episode in energy prices.

The big picture challenge is that most analysts continue to see rising energy demand over the next decade. For example, Morgan Stanley estimated in June that trend oil demand will continue to grow until about 2030 and to around 107 million barrels per day from around 94 million barrels per day currently. Currently, public listed companies contribute around 50% of global supply, but if future capital spending is constrained by the ‘Net Zero’ target, non-public companies (primarily from OPEC) will likely be required to increase supply.

In addition, if supply becomes constrained from public listed companies, that might lead to an increase the incentive price to enable non-public companies to accelerate growth. The bottom line is oil prices might increase rather than decrease as a result of the climate pressure on public oil companies. Of course, that might also accelerate technological innovation and the pivot away from fossil fuels. Therefore, the prevailing bias on trend demand could be wrong.

As we noted on Monday, the episode in energy is also another example of stimulus supported demand encountering limited supply due to pandemic related bottlenecks and gaps in the global supply chain. While some of the supply- driven factors will ultimately prove transitory, they clearly have persisted longer than many market participants and central banks might have expected. Put another way, there is now sufficient evidence of supply shortages and bottlenecks disrupting economic activity that it is a concern for profits. Indeed, arguably the entire US labour market – the gap between supply and demand for labour – is consistent with fewer workers for a given level of compensation and therefore a potential wage price spiral over the coming quarters.

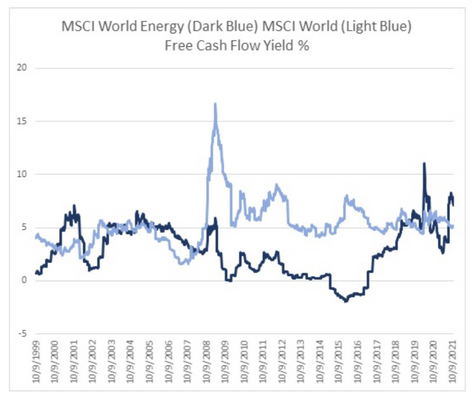

The challenge for some sectors of the equity market is that this input cost pressure has arrived at a time of elevated valuations and peak profit margins. The combination of the supply-driven impact on margins, rate hikes next year and Fed liquidity withdrawal are a legitimate risk for equity prices. While the global listed energy sector has underperformed world equities by around 68% over the past decade, it clearly would benefit from higher final prices. The free cash flow yield is now around 7% or 2 percentage points higher than world equities (chart 1). Of course, the improvement in free cash flow has partly been due to investor led pressure to reign in capital spending and improve returns to shareholders. However, under investment and improved capital discipline exacerbate the supply constraint.

In the medium term, climate related pressure on public listed companies could put downward pressure on world supply with higher prices necessary to incentivise additional production from National Oil Companies (mostly in OPEC) to fill the gap. Perversely, higher prices combined with improved capital discipline could lead to improved free cash flow, balance sheet leverage and shareholder returns for listed companies. However, on the positive side, it might also accelerate technological innovation, alternatives and the pivot away from fossil fuels. It might also improve the relative ESG rating of the listed sector.

The final point to note is that the composition of the “famous ETF” is an anti-energy cluster... of correlation and concentration in liquidity beneficiaries that will be vulnerable to the rapid rise in energy prices, rising inflation expectations, higher rates and liquidity withdrawal (chart 2). Just as inflows supported that ETF on the way up, outflows might contribute to a self-reinforcing reflexive unwind. As we noted on Monday, we would also be cautious on net importers of energy in emerging markets (Turkey and India) as they are also vulnerable to US dollar strength and higher rates.

Disclaimer

Content contributed by Nick Ferres, Advisory Board Member of Conduit Asset Management Pte. Ltd. All information contained in this document is sourced from public source documents, media releases and not from Conduit Asset Management Pte. Ltd., (the “Company”). All due diligence onus, including and not limited to that related to legal and financial documentation, rests on the investor. This document is intended for distribution to “institutional investor” and "accredited investor" types as per definition by the Securities and Futures Act (Cap. 289) of Singapore, or to those who would qualify as such, under one or more of the categories of “institutional investor” and "accredited investor" so described therein. The information and data contained herein are strictly confidential and for information purposes only, and shall not be construed as investment advice, an offer, or solicitation, to deal in any securities. The information is not to be reproduced or transmitted, in whole or in part, to third parties, without the prior consent of the Company. This information is not directed at or intended for distribution to any person or entity who is a citizen or resident of, or located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject the Company to any registration or licensing requirement. This information has not been reviewed or authorized by the Monetary Authority of Singapore, or any regulatory authority elsewhere. Consequently, you should not act or rely upon the information contained herein without seeking professional counsel. The information contained herein may contain statements that are not purely historical in nature, but are “forward-looking statements”. This includes, among other things, projections, forecasts, targets, samples or proforma investment structures, portfolio composition models and hypothetical investment strategies. These forward-looking statements are based on certain assumptions and actual events may differ from those assumed. Neither the Company nor any of its respective affiliates make any representations as to the accuracy of these forward-looking statements or that all appropriate assumptions relating thereto have been considered or stated and none of them assumes any duty to update any forward-looking statement. Accordingly, there can be no assurance that estimated returns or projections can be realized, that forward-looking statements will materialize or that actual results will not be materially different or lower than those presented. Please note that the Company and/or its related companies, and investment staffs, may from time to time hold direct or indirect economic interests via non-controlling stakes into underlying Funds’ Investment Advisory Companies that control the Funds into which the Conduit Partners’ Capital Fund invests. Past performance is no guarantee of future results, and there is no assurance that the investment’s objectives will be achieved. In addition, certain financial information is contained herein. While the Company has made reasonable efforts to include information from sources that it believes to be reliable, the timeliness, accuracy and completeness of the underlying information, and any computations based thereon, cannot be assumed. While the Company has attempted to minimize errors, it has not verified, nor does it guarantee or warrant, the accuracy, validity, timeliness, completeness or suitability of such information and data. The Company is not responsible for any trading decisions, damages or other losses related to the information or its use. Please note that our references to a “Tradeflow USD/EUR Series” herein is made specifically to the CEMP – USD/EUR Tradeflow Fund, ISIN NUMBER: KYG1988M6375/KYG198751300. Conduit Pte. Ltd. is a part owner the referenced commodity trade finance fund’s investment advisor, Tradeflow Capital Management. The Company is currently invested in, and receives compensation for referenced Fund distribution and rebates on direct Fund investments from the Conduit Partners’ Capital Fund into the CEMP – USD/EUR Tradeflow Fund. For references to “VPAM Asian Macro” herein is made specifically to the “Vantage Point Asian Macro Fund”, the Company received compensation for the referenced Fund distribution and rebates from Vantage Point Asset Management Pte. Ltd.

Comments